Commercial

Solar Power

Take Control of your Energy

Why Solar for Your Business?

Energy Savings

Solar will save your business money everyday and protect it from rising energy rates

Solar Incentives

Limited-time incentives reduce the cost of commercial solar by 50-70%

Sustainability

Going solar sends a powerful signal that your business's commitment to sustainability is more than just talk

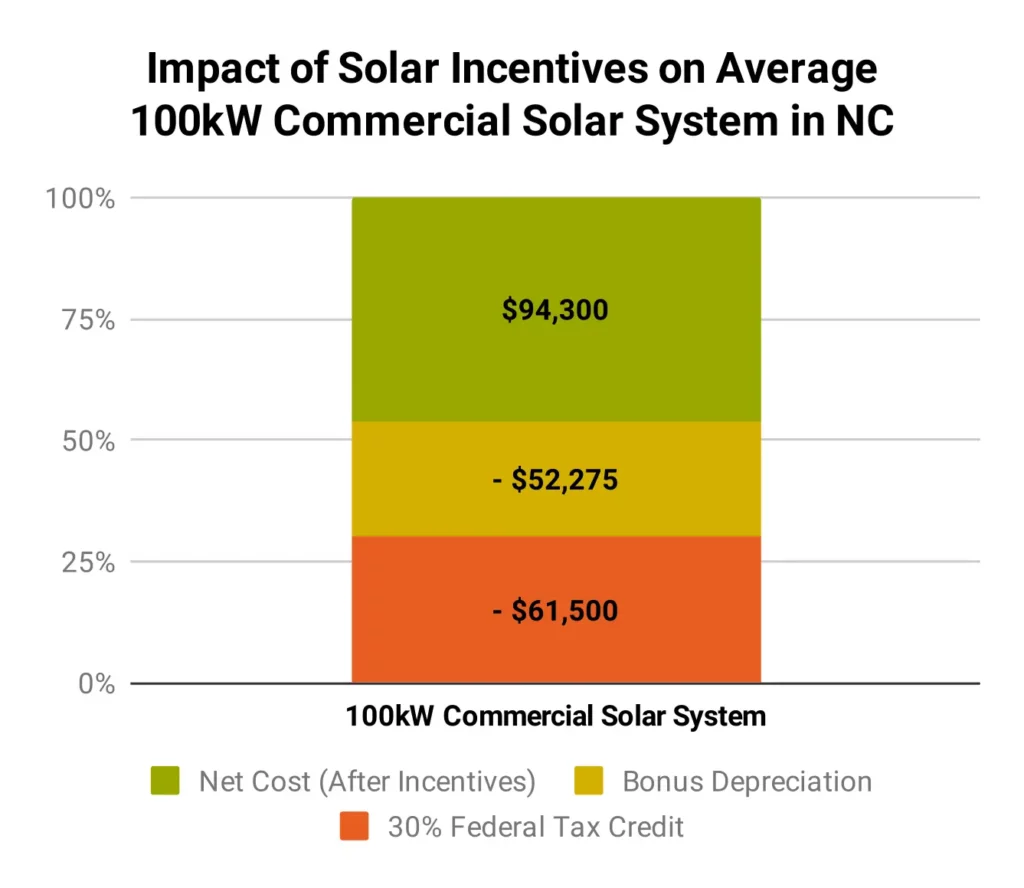

North Carolina's Commercial Solar Incentives

The federal tax credit for solar takes 30% off of your commercial solar system’s price right out of the gate.

Commercial solar systems are eligible for accelerated bonus depreciation providing additional 20-35% tax savings.

Eligible farms and businesses can apply for a grant worth 25% of the project cost (up to $500k).

Commercial Solar Incentives Stack Up Fast

When you stack all of the incentives available for commercial solar in North Carolina, you can see the net cost of your solar system drop by 50% or more of its turnkey price.

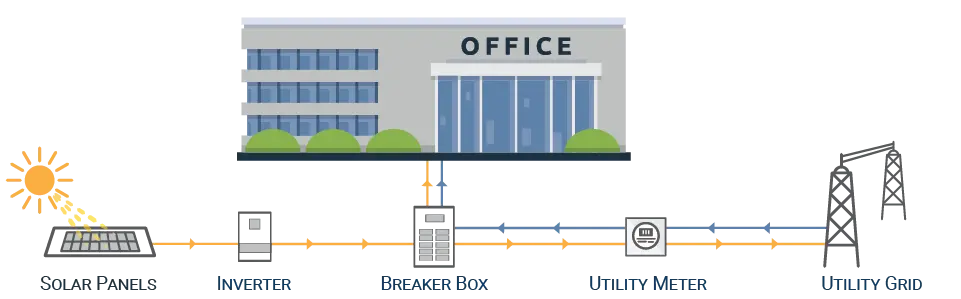

How Solar for Your Business Works

1

Solar panels convert photons of sunlight into direct current (DC) electricity

2

An inverter converts DC energy from the panels into alternating current (AC) electricity for your business

3

The AC electricity is sent from the inverter to the main electrical panel to power the building with solar energy

4

A smart meter measures both your solar production and energy use. When you produce more solar energy than you need, the meter spins backward and you receive a credit from your utility

5

When you are not producing solar energy, the utility supplies your electricity. Your utility bill is offset by the solar energy you produce everyday

Recent Solar Installations

Why Southern Energy Management?

Southern Energy Management has been North Carolina’s trusted commercial solar installer for more than 20 years. In that time, our team has installed more than 3,000 solar power systems across the state. Based on our years of experience, we’re confident we can find the right solar energy solution for your business!

We believe business should be used as a force for good.

About Us

North Carolina’s solar power and building performance expert. Founded in 2001, we’ve worked for 20+ years to improve the way people make and use energy.

© 2023 Southern Energy Management, Inc.